Money makes the workd go round. True? Some would agree, some would disagree. Money is one topic that isn’t openly talked about like sex. Most don’t want to talk about it for several valid reasons. I for one, have apprehensions talking about it. I feel like it can sometimes stir up an argument or cause judgement to those involve.

To be honest, finance isn’t my thing. I always say “I love money but I hate numbers!” Heehee. Anyway, part of SoMom’s Better Me campaign is to enhance our knowledge in the many aspects of our lives, one of which is learning more about money. So we had an intimate financial talk sponsored by AXA Life, where known financial adviser Rose Fausto clued us in about FQ (financial quotient) and how important it is to learn about it.

In order to talk about money and understand it, it is a must to have good food. Thankfully, our session was held at New World in Makati. They have an open kitchen function room that’s perfect for intimate gatherings such as our financial session.

Fresh fruits and freshly baked pastries.

Coffee and tea to jumpstart our morning.

While the chefs prepared our lunch, we listened to Rose Fausto.

Rose Fausto is a financial adviser who was once an investment banker. She woke up one day feeling burnt out and decided to trade her banking career for some quality time as a homemaker and hands on mom to her three boys. It is very natural for Rose to take a path as a financial adviser soon after she quit her job as she has a knack for finance and investments. Here, she talked about how one should have high FQ (financial quotient) to make better decisions when it comes to investments and money. As a mom, she also gave us pointers on how to talk to our kids about money, saving in particular.

To start, we were asked by Rose to look back at our childhood money memory. Here’s me sharing to the group about my childhood money memory. When I was a child, we never talked about money, at least openly. I guess my parents never liked the idea because it is a tricky topic. Like most conservative families, talking about it can lead to heated discussion. As what Rose said, most of the time it is not the amount of money that concerns most families but rather the manner in which it was openly discussed or lack thereof.

I can sum up my takeaway from the session into three: develop your FQ, talk about money and make a plan.

DEVELOP YOUR FQ

FQ or finanical quotient is the measure of financial intelligence. It is somewhat similar to IQ, only it is focused on finances, the relationship we have with money and how we handle it.

To develop one’s FQ, one must map out his or her finances. To start, you can create a balance sheet and list down everything your own (assets- can be cash, stocks or material things you know are of value) and your liabilities and equities (mortgage, debts, monthly staple spending). From here, you can clearly get a look at where you stand financially. If you have more liabilities than assets then you have two choices: either cut your spendings or increase your income. It may be difficult to do the latter compared to the former so I suggest, start by spending wisely. But if you want to increase your income, you can start investing. As what I learned, you can start by buying stocks as an investment. If you have low-risk appetite like I do, then this is something you really need to learn before doing.

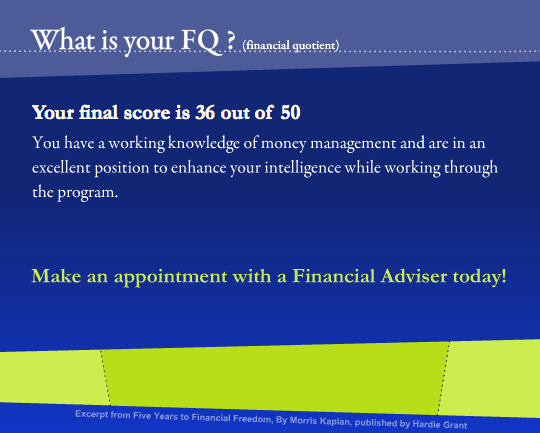

I took the liberty of taking the FQ test online. Here’s my result.

In fairness, for someone who isn’t knowledgable about finances and the nosebleed terms, eh my score isn’t as bad as I think it would be. May future pala ako sa finance! Charot! Anyway, you can also take the FQ test to know your FQ.

TALK ABOUT MONEY

As a family, each member should be open when it comes to money. Of course it starts with the parents. The ability of the couple to talk about finances can fail proof their future and their children’s. If you’re a parent then teaching your child about FQ at an early stage in his/her life can help him/her develop a good relationship with money. That money talk isn’t boring nor complicated. And that money should work for them, not the other way around. Discuss and set goals for yourself and for your family. Track your monthly spending and plan your annual expenditure ahead so you can save up. I’ve also learned that the proper equation should be:

INCOME – SAVINGS = SPENDING and not INCOME – SPENDING = SAVINGS

If my husband’s reading this, I swear he’ll rub this in on me! Fine, fine. Less spending, more saving na nag eh! 😉

Prioritize saving over spending. Don’t be afraid to ask your spouse about the family’s income and your projection for your money in the coming years. As a homemaker it isn’t enough to manage the household expense, you too must be involved in mapping out your family’s finances. Be involved and if you have high-risk appetite, you can even try and invest yourself. It’s not as scary nor complicated to talk about money if you have good intentions to begin with especially if it’s for the future of your family. Remember, if you are knowledgable then you are more prepared and capable to talk to your kids about saving up.

Did you know kids have a high spending power of $1.6 billion?! (in a recent study made by Cartoon Network) Kaloka lang di ba?! Not to mention they also have high influence when it comes to their parents spending. Yep. Be afraid, be very afraid. Heehee, joke lang. This just means that as parents, it is our responsibility to prepare and groom them to be wise spenders. That is why it is important to know your FQ so you can teach your kids to have good FQ as well.

MAKE A PLAN

It isn’t enough to talk about money without having a concrete plan on what to do about it. You can start with an attainable goal. Plan a savings goal at the end of each year to keep you motivated into saving. You can also make a yearly projection of what you want your money to do to you so that you know where you’ll invest it in (business, stocks, mutual fund, life plan, time deposit). But if you are uncertain about it you can always talk to a financial adviser to give you tips and advise tailor fit to your situation.

Thank you Rose Fausto for the very touching and informative talk. I have learned so much! Thank you as well AXA Life for sponsoring this empowering session for the SoMoms. I am more eager to save and hopefully invest on things that’s suitable for me and my family.

I got a copy of Rose Fausto’s book Raising Pinoy Boys that has a chapter dedicated to finance. I’m excited to read it as I know it’ll help me develop not only my son’s financial quotient but of my daughter’s too.

To know more about fail proofing your future go to https://www.facebook.com/FailProofYourFuture.

Sign up at HERE and get a chance to win gift certificates from Gymboree, The Mind Museum and even a trip to Legoland Malaysia.

Get a chance to win any of these prizes:

MINOR

Learn & Play Package (Annual Membership in Gymboree for kids aged 0-60 months old, includes 5 gymplay coupons. (10 Winners)

Explorer Package

Mind Museum all-day passes for 2 adults & 2 children. (10 Winners)

Nido Discovery + Inventors’ lab tickets for adults & 2 children (10 Winners) > Four “Pacific Sky Wonder 9” tickets in Manila Ocean Park (10 Winners)

School Supplies Package

Gift Certificates from National Bookstore worth P5,000 per winner (10 Winners)

MAJOR

Skills Package

Yamaha School of Music (12 lessons/1hr/lesson; choose from basic guitar, piano, violin, flute. (4 Winners)

Center for Pop Music (Starborne Regular, 18 sessions/2hrs/session) (4 Winners) Gadget package

Desktop & printer set (2 Winners)

Grand Prize

Trip for 4 (2 adults & kids) to Legoland Malaysia (1 Winner)

Like AXA Philippines on Facebook to know more about their education solutions or to talk to a financial advisor.

Happy Hump Day!

[…] to Rose Fausto about managing our finances. You can read some of the financial tips Rose discussed HERE. As for us moms, here’s what we picked up from the morning talk with […]