Finally, there’s a no-fuss, easy way to get insurance! And the best part – we can get it online, all thanks to AXA!

AXA is a global leader in insurance that takes care of 103 million lives in 59 countries worldwide having given out US$15 billion in customer benefits and invests in technology to pioneer solutions and services that can continuously meet the customer’s ever-changing needs. Here in the Philippines, AXA is one of the leading and fastest-growing life insurance companies and has partnered with the Metrobank Group, one of the largest financial conglomerates in the country.

Getting insurance back in the day would entail a lot of paperwork, reading, and discussing, and sometimes the tediousness can lead to disinterest. But the landscape of insurance is slowly changing and have come to adopt technology and AXA leads this through AXA iON (or AXA Insurance Online). I’m so glad that learning about the different plans is now made easy.

AXA iON is the Philippines’ first online life insurance store that offers an easy and convenient way to avail of AXA’s financial products. It’s super easy as 1-2-3, literally!

First, just visit https://ion.axa.com.ph/.

Second, select the product that fits your financial need.

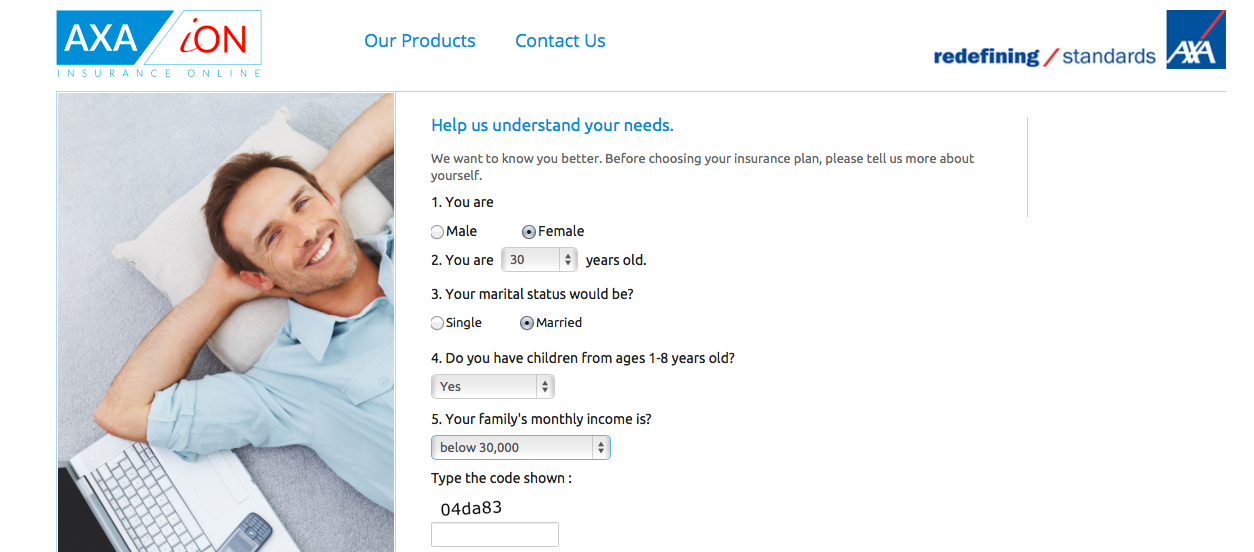

It will prompt you to answer a few questions that can better understand your needs.

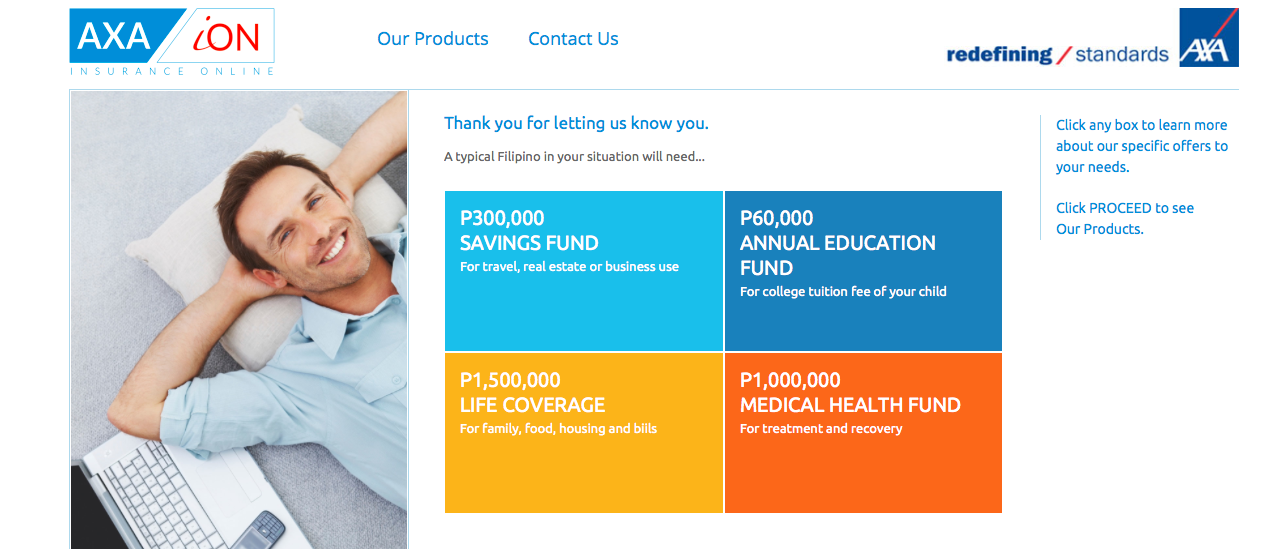

AXA iON offers four products that make up the AXA eXentials line, which are designed to be affordable with premiums starting at only P1,000 per month:

Health eXentials, Savings eXentials, Academic eXentials, and life eXentials.

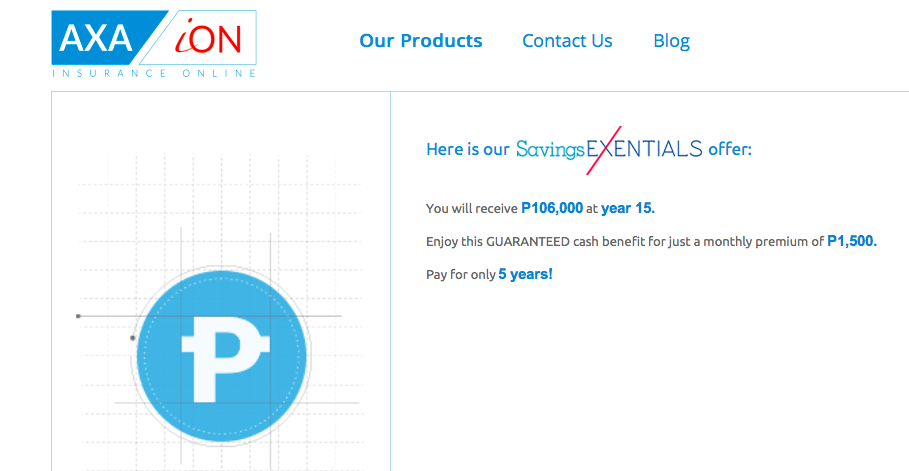

Savings eXentials – a fail-proof alternative to savings that provide better returns than a savings account, and pays out cash to your family even if you don’t complete the 5-year payment in case of death or disability.

Sample quotation:

Academic eXentials – gives guaranteed cash benefits once a year for 5 consecutive years, to help defray costs related to tuition or education. But in case of your untimely demise before the 5-year payout period, Academic eXentials will give your family additional cash every year until the year before the scheduled release of benefits.

Sample quotation:

Life eXentials – a basic insurance plan but unliketypical life insurance plans, Life

eXentials pays out its benefits monthly over a period of up to 5 years so there’s no danger of wiping out the insurance proceeds at once and ensures that the beneficiaries get a monthly stipend to help replace the income of the loved one who passed away.

Sample quotation:

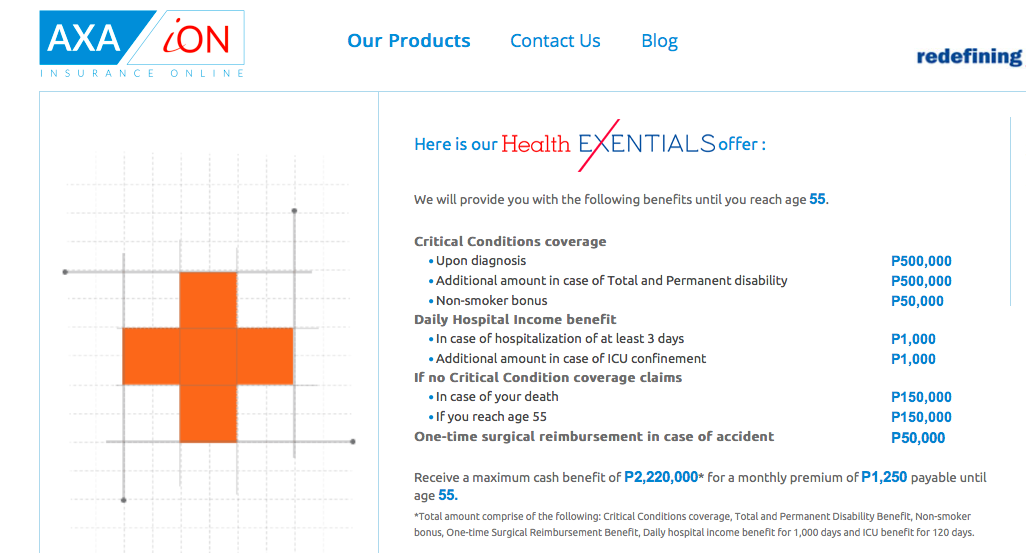

Health eXentials – an affordable complement to HMO coverage as it pays out cash upon diagnosis of any of the 36 covered critical conditions such as heart attack, stroke, including gender specific cancers.

Sample quotation:

What I like best about AXA iON is that I can easily get quotations on any of the insurance products that I want.

Third, pay via credit card for the first premium.

Your credit card will automatically be enrolled in the Auto Charge Arrangement so you don’t have to worry about forgetting to pay your monthly premiums.

AXA iON is perfect for young professionals, newlyweds, even college students who are digitally savvy and want an easy and convenient way to start preparing for their financial future. It was such a delight exploring AXA iON and I never thought I’d enjoy shopping for an insurance online. Now availing for health, educational, and investment plan is so easy and hassle-free with AXA iON.

Go visit https://ion.axa.com.ph/ and start shopping for your future, today.

Leave a Reply