I turned thirty last year and it became a turning point for me because being thirty means I’m no longer exempted to be an adult and do adult things. Though I have been quite independent growing up–I took care of my college fund & have not been asking my parents for anything since I started working–one of the things I admit I’m not good at is managing my finances.

But don’t get me wrong, I do like saving. In fact, I regularly save for the things that I want.

Back when I was in college, I used to save some of my money for a trip to the salon to get a manicure or pedicure. Yup, that’s my mani/pedi fund money purse which up to now I use from time to time. 🙂

When I started working after I graduated from school, I didn’t drastically change my behavior when it comes to my hard earned money. Though I have savings, I still put aside enough money for my bag fund.

Growing up with two older sisters, I’m used to hand me downs and sharing most of the things I have with them. When I started earning, I found a sense of fulfilment in buying the things I once wanted but couldn’t afford. Now that I can, I find myself having a bag fund and shoe fund.

Can you blame me? There’s just too many pretty bags and shoes in the world! 😀

I used to justify my bag and shoe purchases to my husband as my investments. They are actually investments as some tend to increase in value over time. But really, who am I kidding? These material things, when not preserved well, can depreciate over time.

My ever supportive husband, Mr. JG would always remind me that my investments aka bags and shoes aren’t really good investments especially for someone like me who tends to use them until they no longer serve their purpose. At first I defensively reacted, because they were the investments I chose, I had to justify that over time these luxury items will cease to be produced and can no longer be available for purchase by the time lil’ Ms. JG is in her 20s. But after hearing myself defend my bags and shoes–positively assuming they’ll be worth more than what I paid for them a century or two from now– I knew I needed to make real investments to fund for my future (read: retirement).

That’s when I researched and found out about ALFM Mutual Funds through their website.

HOW DO ALFM MUTUAL FUNDS WORK?

ALFM Mutual Funds are pooled funds. Meaning, the company pools together their clients’ money and invests it in different channels like, stocks, bonds, time deposits, and the like. Because the funds are invested in a mixture of these instruments, they have the ability to give out higher returns than normal savings accounts or time deposits. However, they are not guaranteed. At first, I was a bit hesitant because of this, but then, I realized that my other investments – my bags and shoes – actually don’t provide guaranteed returns as well. Might as well give it a shot, right?

I was also reassured by the fact that the funds are handled by experienced fund managers who ensure that they perform well and achieve the best returns possible. Someone taking care of my money while I spend more quality time with Mr. JG and lil’ Ms. JG? Yes please!

KNOWING MY RISK PROFILE

Different mutual funds have different objectives and each mutual fund is elaborately explained at the ALFM Mutual Fund website. Since there are 6 different ALFM Funds available, I took the risk profiling test to know up to what level of risk I can tolerate and what type of fund would best suit me. You can take it online on the ALFM website, like what I did, or you can take it when you set an appointment with an ALFM Investment Counselor at your preferred BPI or BPI Family Savings Bank branch.

I answered a few questions about my future goals and how comfortable I am when it comes to investing.

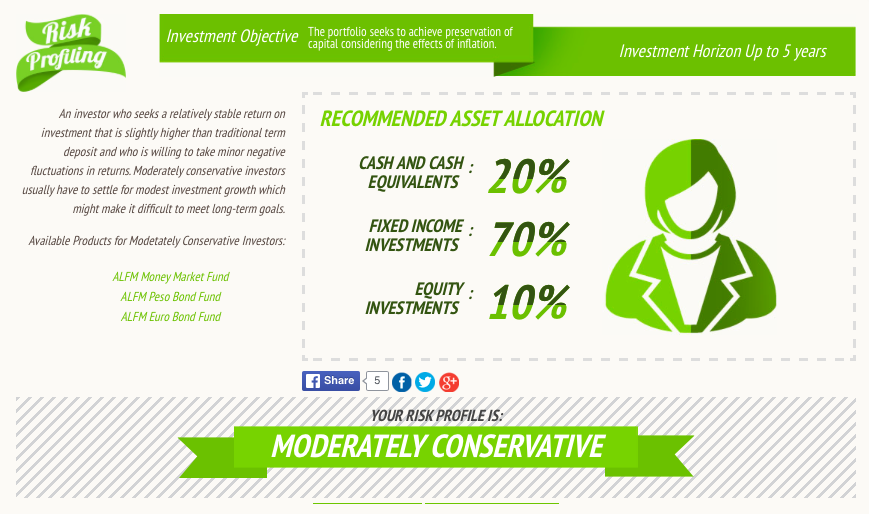

My result?

I’m a moderately conservative investor. I was surprised that this was my result. I assumed I was a very conservative investor since investing my money in Mutual Funds was a thought that I never considered. It was refreshing to know my outlook when it comes to investments have changed–knowing I can generate appropriate earnings in 5-10 years made more interested to have a mutual fund!

UNDERSTANDING THE FUNDS

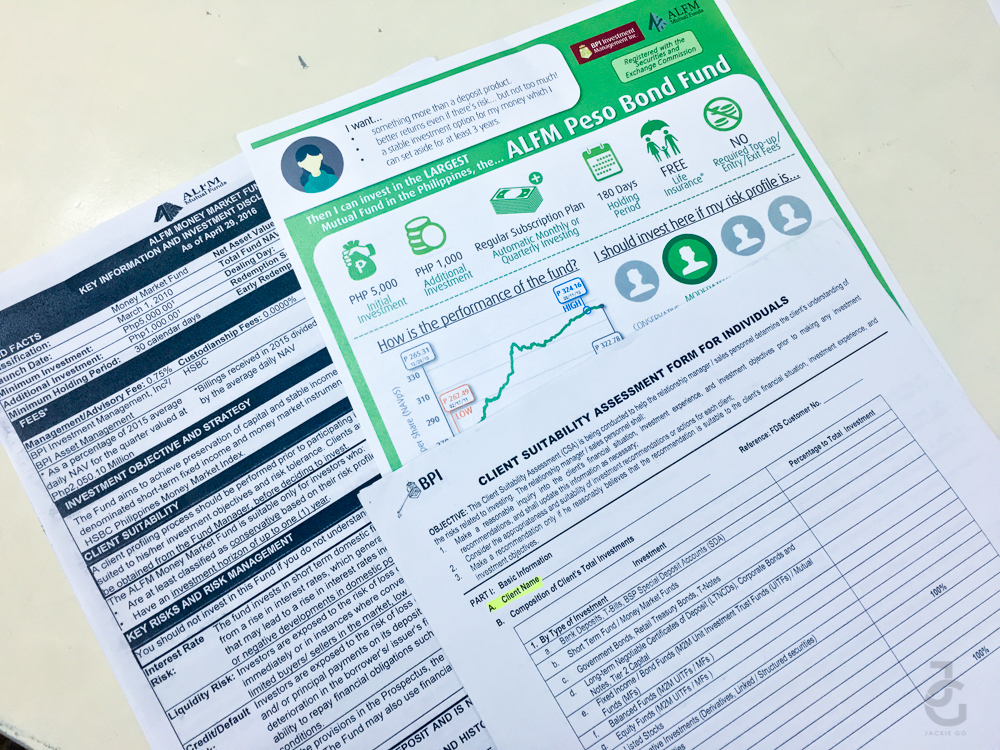

After browsing the ALFM Mutual Fund’s website, I decided to set an appointment with an ALFM Investment Counselor who could explain more about my different investment options. (By the way, to set an appointment, just leave your details on their Contact Us page.) I didn’t hesitate to ask her even the most silly-sounding questions because I want to be sure that I choose the right mutual fund for me. I even told her how legit it feels like to finally have a real investment–I’m finally embracing adulthood!

To give you an idea, here are three of the seven ALFM Mutual Funds which I’ve come to understand during my meeting with my Investment Counselor,Kim.

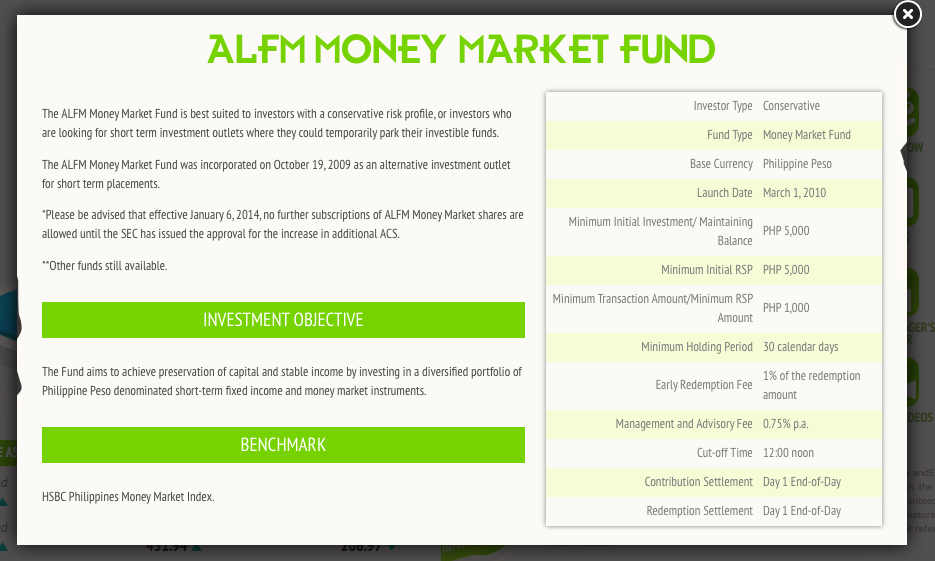

1.) ALFM MONEY MARKET

Kim told me that this fund is suitable for those looking for low-risk investments because it mostly contains instruments similar to time deposits that offer higher rates, usually because of higher initial deposit amounts. Compared to just one person shelling out 5k for a single time deposit, imagine 1,000 people shelling out 5k each, all investing as one big bulk! They can usually bargain for higher rates when the deposit amount is higher.

RETURNS

Since this is a low-risk investment, returns are less compared to other ALFM Funds. Historically, a year’s earnings would be at a range of 1-2% net. Seems low? A time deposit or just parking money at a savings account might not even give out 0.5% net so this might be a good option to consider.

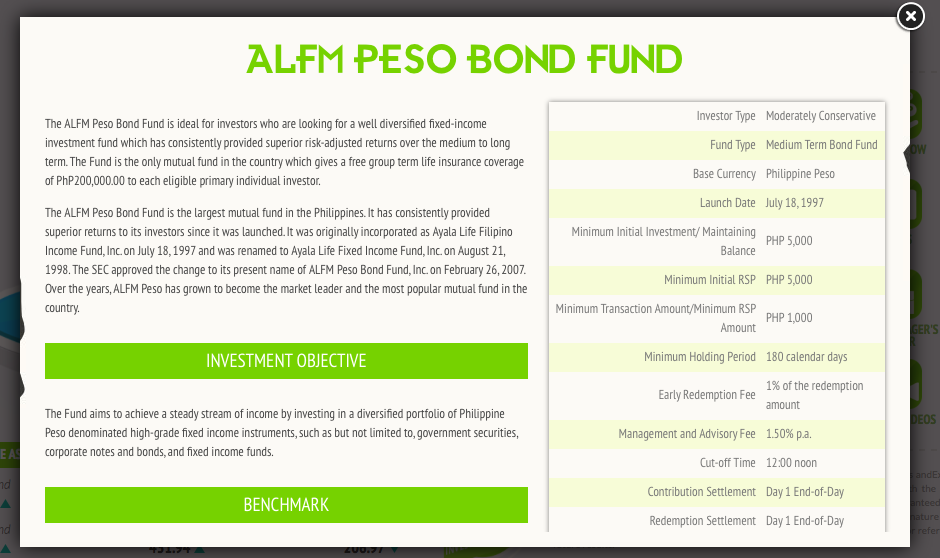

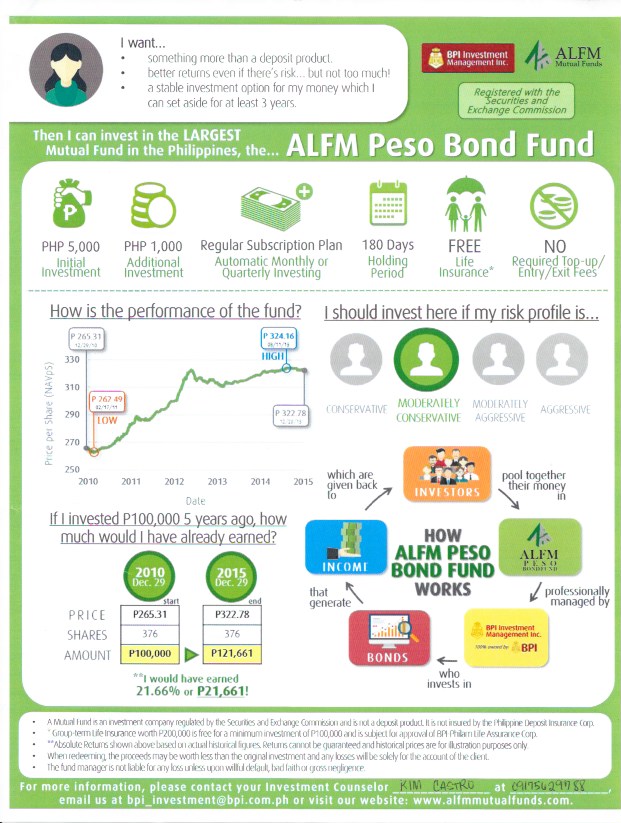

2.) ALFM PESO BOND FUND

Kim explained that this fund is for those who can tolerate medium- risk because it contains mostly bonds. She said that Bonds are like loans. Lenders earn through the fixed interest being paid by the bondholders for loaning their money. These bonds are usually from big public companies or the government and are issued when they need money for a project that would need huge funding.

RETURNS

Since this is a medium-risk investment fund, the returns are presumed to be a little higher than ALFM Money Market Historically, a year’s earnings are at a range of 2-3% net. This is already great for someone who does not like risk just like me!

Kim mentioned that since this is a bond fund, the biggest risk comes from the possibility of interest rates moving up which will affect the fund’s price. She assured me that I should not worry especially if I don’t need to withdraw if indeed rates moved up. I told her that’s okay since I am looking for an investment for the longterm.

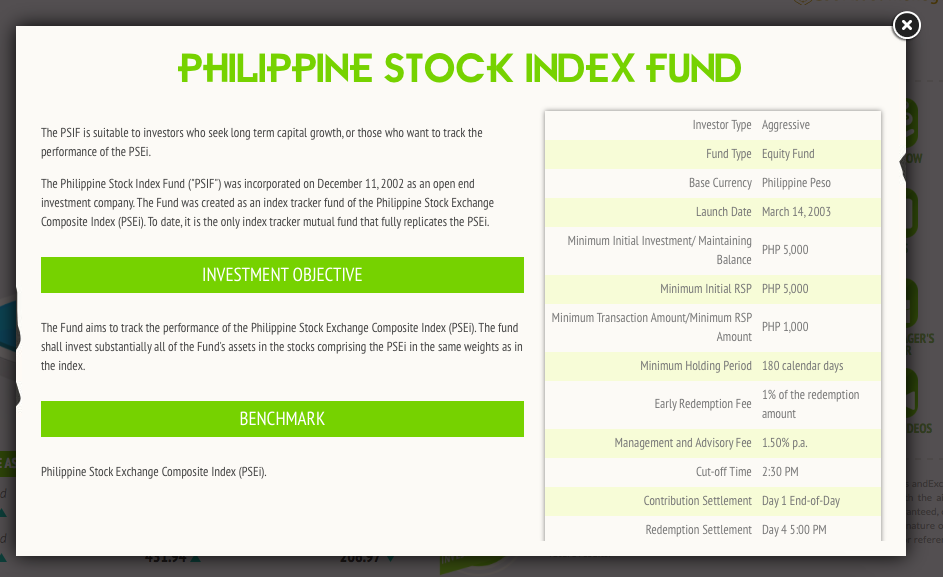

3.) PHILIPPINE STOCK INDEX FUND (PSIF)

Kim said that this fund invests in businesses through the stock market. The businesses/stocks the fund managers choose are those that comprise the PSEi. She explained that PSEi contains a select group of companies (around 30 different corporations) that represent the Philippine Stock Market. Since the Fund is invested in businesses, there is higher risk involved because there might be companies who do not perform well which will result to poor fund returns. On the other hand, if companies in the PSEi do perform well, then it will be reflected by the fund’s returns as well.

RETURNS

This fund’s growth is best observed over a long period of time which Kim suggests as 5 years or more. Why so long? If you think about it, a successful business does not usually last for just 1 year. Most businesses I know even encountered problems during the first year before they thrived the succeeding years.

A 5-year return on the average would be at a range of 10-15%. There is also a possibility of loss as what happened last year when the stock market is down by 1.3%. But as Kim pointed out earlier, returns of stock funds like this are best observed over long periods of time. She also told me that the current state of the Philippine economy is very good and the prospects are very promising that it will surely reflect on the performance of the companies and the stock market in general. I believe that because I usually read this on the business section of the newspaper every morning.

Imagine, double-digit returns without having to monitor anything! So I’m thinking… If I invest my bag fund here, after 5 years, I might be able to buy 2 bags already! Kidding aside, I can probably start investing for lil’ Ms. JG’s college fund.

I’m very confident that after researching and reading through each mutual fund, I made the right choice based on my risk profile.

Thankful also to Kim and to my BPI bank manager for assisting me through the whole process.

I like ALFM Mutual Funds because:

- It’s an easy way to start an investment. All the things you need to know you can read on their website

- You only need Php 5,000 for initial investment. Imagine, that’s only sacrificing your daily venti Frappuccino for a month!

- You can easily manage/ subscribe/ redeem your investment online thru your BPI Express Online or BPI Express Mobile Accounts.

- You can also apply for a Regular Subscription Plan (RSP), which according to Kim is the secret to being rich! This is because the RSP will auto-invest a minimum of P1,000 from your savings account, monthly or quarterly. It’s like forced-saving for your future goal.

- It comprises 42% of the mutual fund industry, making it the largest and biggest mutual fund company, proving its stability.

Having my own investment account made my being an adult as serious as it can be. I regret not having this done sooner but I’m glad I did it now that I’m 30. I’m more confident that my investments through ALFM Mutual Fund would garner me earnings ultimately more than my bags and shoes would in five years or so.

I even told my Investment Counselor, Kim, how excited I was to finally convert some of my savings to investments because now I understand how mutual funds work and how it can be a good way to fund for my future today.

If you’re thinking of saving up for a bag or shoe fund, why not pay yourself first and invest in a mutual fund today? I wish I’d done this sooner, this is by far the best “investment” I’ve ever had in my life.

To know more about ALFM Mutual Fund visit their website at http://www.alfmmutualfunds.com. You can also send an inquiry by messaging them through Facebook. They can guide you and help you learn more about investing and opening an account.

What is the history of ALFM Mutual fund? When does it starts and who owns it?