My lil’ Mr. JG celebrated his birthday two months ago. And for his birthday present, I opened a Security Bank for him. I know he’s too young to manage his own money but like what Rose Fausto said, no one is ever too young to have his own bank account. So instead of letting him immediately spend his birthday money he got from his godparents to buy what he wants for his birthday, (he already got his birthday wish from us anyway) I started a UITF account on his behalf.

Better Me hosted an intimate event a few months ago sponsored by Security Bank to teach kids know how to save up. It’s pretty easy to open an account with Security Bank. All it takes is just three easy steps:

- Fill form online

- Wait for a message

- Go to you preferred branch to finalize

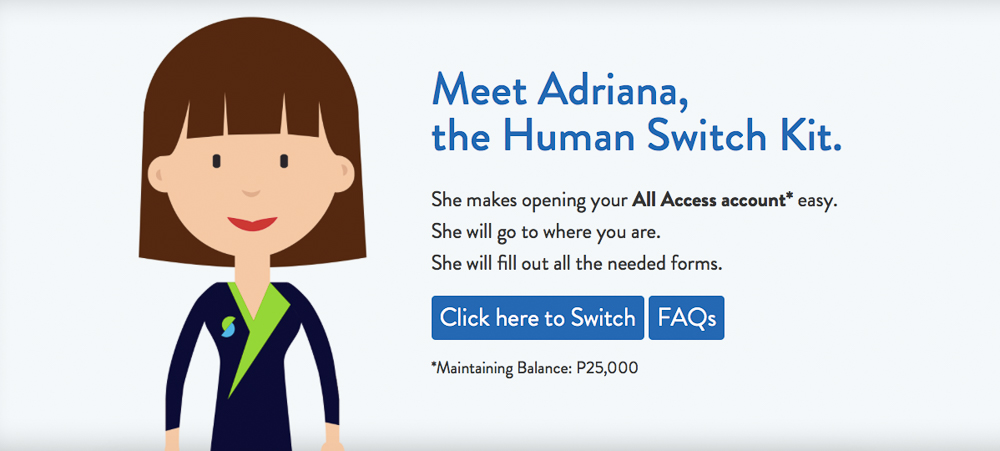

If you cannot go to a Security Bank you can instead let their Human Switch Kit go to you wherever you are.

Opening an All Access account is easy and at the comfort of your home or office.

It’s as easy as 1,2,3!

- Leave your name and contact details HERE

- Wait for a message or a call and schedule when’s the most convenient time for you to meet a Security Bank personnel so you can finally make the switch.

- Meet the Human Switch kit in your home or office.

To know more about Security Bank’s Human Switch Kit, click HERE. Be sure you have a valid ID to present and the initial deposit ready when you meet with a Security Bank personnel.

A few minutes after leaving my contact details, I got a call. Supposedly, a Human Switch Kit will come to my home but since there’s a Security Bank that’s super near where I live, I decided to head out for my UITF account.

What is a UITF?

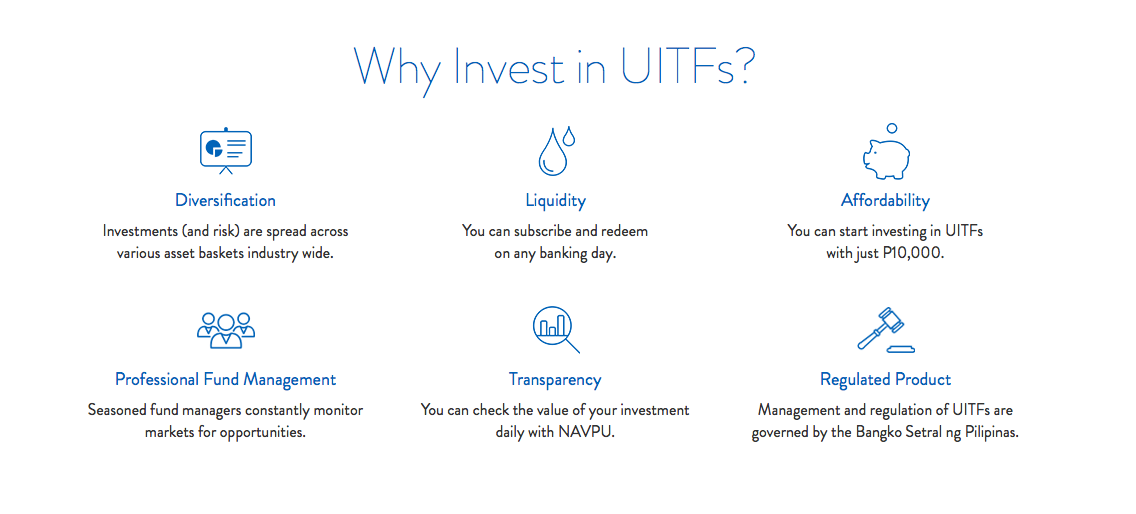

A UITF is a curated investment fund that is managed by experts to ensure high yield and quality returns. You can enjoy the profits of a diversified portfolio by purchasing units of participation in the fund. It’s the perfect investment option if you don’t have the time or knowledge for actual stock trading because it lets experts manage your investments through securities, bonds, equities, and other best-in-class instruments.

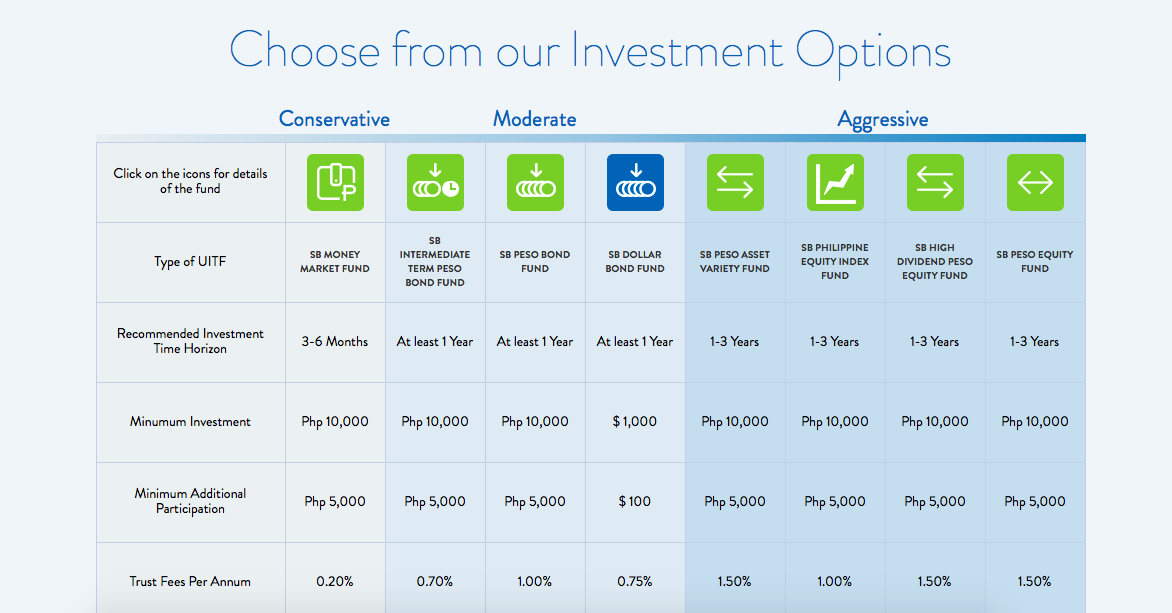

If you’re afraid of investing but really want a portion of your money elsewhere aside from your savings account then UITF is the way to go. There are eight types of UITF you can choose from depending on your risk appetite and goal.

UITF is a good way to make your money grow. My husband and I decided to put a portion of my kids’ money gifts so their money can grow along with them. Initial investment is at Php 10,000 and additional participation is at Php5,000. If my kids can pool their Christmas & birthday angpaos, I’m sure over time their UITF will grow and when they’re old enough, I can easily turn over the account for them to personally manage.

I feel such an adult to be able to manage my (as well as my kids’) finances right. I promise myself that I’ll give my kids opportunities to grow and I think managing their money is one way to do it. You don’t have to start big, in fact you just have to start small and start early when it comes to money and finances.

To know more about Security Bank UITF click HERE.

Leave a Reply